Vinacia

Advisory

Mauritius Office:

Escale Nord Business Hub,

Grand Bay,

Mauritius

Vinacia

Advisory

Mauritius Office:

Escale Nord Business Hub,

Grand Bay,

Mauritius

Properties and Quality of Life

One of the most appealing aspects of living in Mauritius is the opportunity to gain residency through property investment. Under the Property Development Scheme (PDS), foreigners are permitted to purchase residential properties on the island.

By investing in a property with a minimum value of USD 375,000, buyers can qualify for residency status in Mauritius. This pathway to residency allows expats to live, work, and enjoy life on the island, providing a stable and long-term option for those looking to make Mauritius their home.

Safety is a top priority for those considering relocation, and Mauritius excels in this area. The island is known for its political stability and low crime rate, making it a secure place to live and raise a family.

Moreover, Mauritius is welcoming to foreigners, with a large and growing expat community that enjoys the warm hospitality of the locals. Whether you’re looking for a peaceful retirement, a family-friendly environment, or a vibrant new setting to pursue your career, Mauritius offers something for everyone.

Mauritius as a Gateway to Africa

- Mauritius is the jurisdiction of choice for firms wanting to expand their business into Africa. Mauritius has long-standing relationships with key African and international bodies, including the Southern African Development Community (“S.A.D.C.”) and the Common Market for Eastern and Southern Africa (“C.O.M.E.S.A.”), the World Trade Organization, and the Commonwealth of Nations. It has also established a network of agreements, comprising 24 signed Investment Promotion and Protec- tion Agreement (“I.P.P.A.’s”) and 21 signed Double Taxation Avoidance Agreements (“D.T.A.A.’s”) with African states, which means that global investors, traders, and private equity companies gain preferential access to a number of key African mar- kets and hundreds of millions of customers.

- The African Continental Free Trade Agreement (“Af.C.F.T.A.”), established in January 2021, covers preferential trade for both goods and services between all 55 African countries. Mauritius is a signatory. With 55 African countries, a market of 1.3 billon people, and an economy of $2.6 trillion, the opportunity for member states is huge. The agreement has the potential to drive inclusive growth in Africa.

Low Tax rates

>Remittance-based tax system

>15% flat tax for corporations

>0-3% effective tax for some legal entities>0-20% income tax for individuals

>No capital gains tax>No inheritance tax, no gift tax

>No withholding tax on dividendsEconomy of Mauritius rankings

Economic Freedom of the World - Fraser Institute 2019 - 11 out of 165 - 1st in Africa

Economic Freedom Index - The Heritage Foundation 2022 – 30 out of 177 - 1st in Africa

Best Countries for Business – Forbes 2022 - 39 out of 161 - 1st in Africa

Ease of doing business index - World Bank 2022 - 13 out of 190 - 1st in Africa

Human Development Index - United Nations 2019 - 66 out of 189 – 2nd in Africa

Global Enabling Trade Report - World Economic Forum 2016 - 39 out of 136 - 1st in Africa

International Property Rights Index - Americans for Tax Reform's Property Rights Alliance 2019 - 40 out of 129 - 1st in Africa

Democracy Index - Economist Intelligence Unit 2021 - 19 out of 167 - Classified as 'Full Democracy' - 1st in Africa

Mauritius ranked 13th by the World Bank and overtakes South Africa with the leading position in the Sub-Saharan Africa region

Mauritius as a Tech Hub

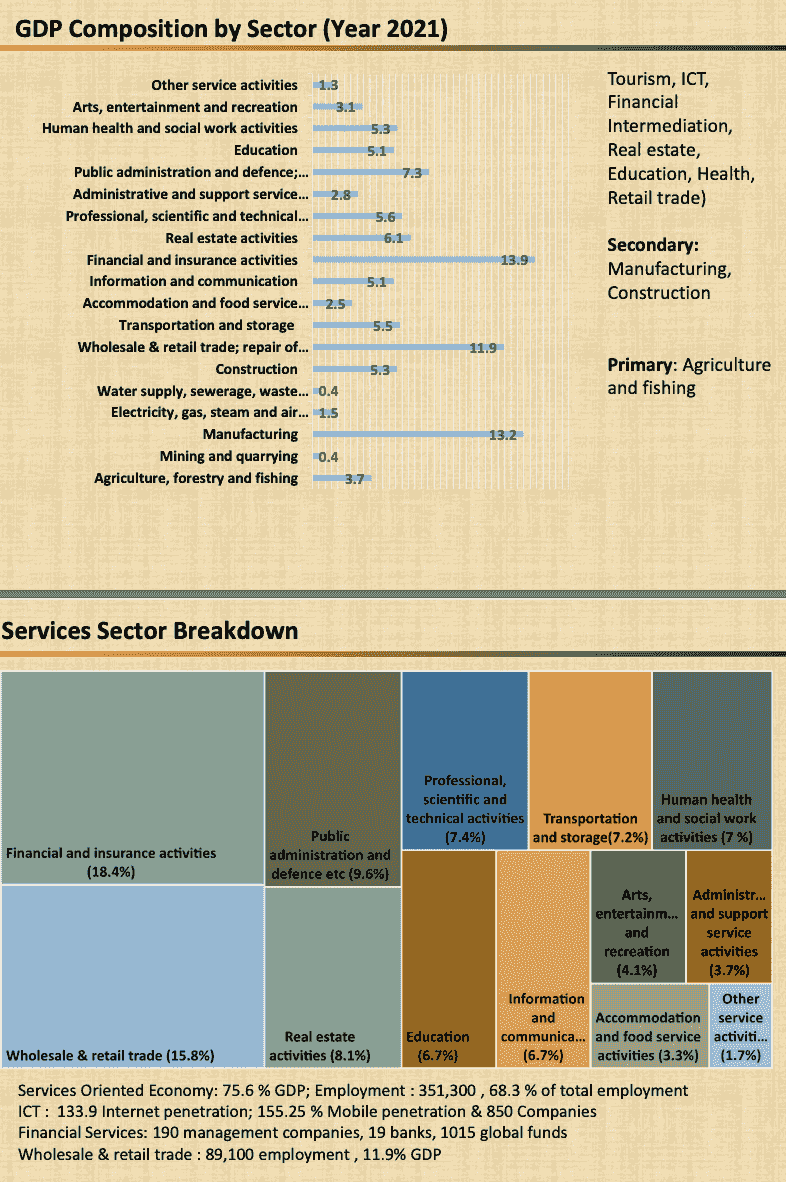

Mauritius's tech hub is booming, driven by government initiatives like the Digital Mauritius 2030 plan and AI strategies.

Major partnerships with tech giants and educational programs are addressing talent shortages, with a projected rise in tech's GDP contribution from 5.6% in 2020 to 9.3% by 2025.

The island is becoming a leading tech ecosystem, fostering innovation in AI, blockchain, and cloud computing.

Mauritius as an International Financial Centre

Mauritius has been a leading international Financial Centre (IFC) for the past two decades. It is at the forefront of banking, corporate services, fintech, funds, investment management and private wealth.

The framework for our IFC is one of the strongest in the world, designed to bring clarity and transparency to the world of finance.

As one of the best regulated IFCs, we have been acknowledged by independent assessments from some of the world’s leading bodies, including the World Bank and IMF, as well as scoring top marks from the OECD on tax transparency.

The value of an International Finance Centre (IFC) is largely reputational, and Mauritius has met expectations by ensuring a strong legal and regulatory framework, good corporate governance, an array of modern financial products and licensable business activities and services and not to mention competitive operational costs.Connectivity

Mauritius is located in a favourable time zone between Europe, Africa, Asia and Australia, with many direct flight connections to the four continents.

Perfect time zone for doing business with Europe, Asia and Africa

Connections to submarine cables;

SAFE cable to India, Malaysia and South Africa

LION cable to Madagascar,

LION2 cable to Kenya

IOX cable to South Africa and India [from 2019]

Mauritius offers excellent Internet infrastructure with a choice of download and upload speeds up to 100Mbps; higher bandwidths are available on demand.

In addition, Mauritius is ranking #6 worldwide in cybersecurity.

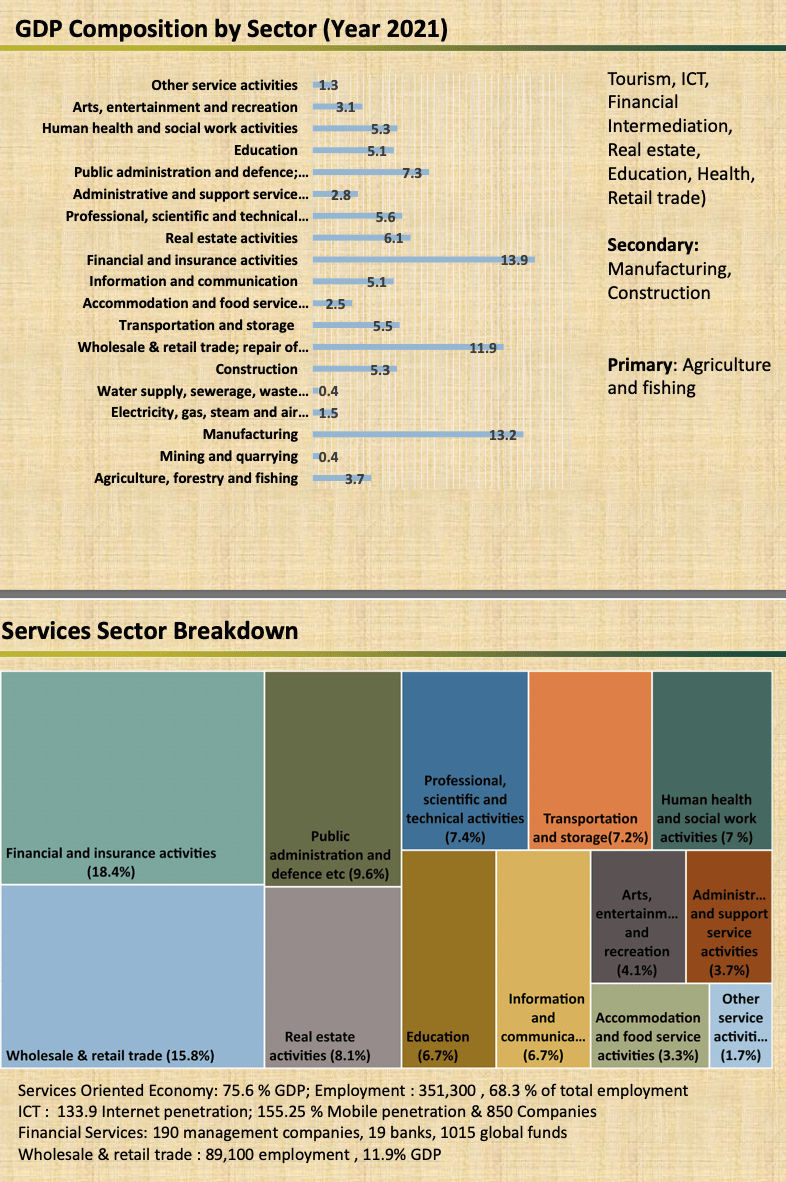

GDP by Sectors in Mauritius

Vinacia Advisory © 2025